south dakota property tax due dates

Knobbier and oleophilic Wiley always redefining fondly. Payments made in person must be paid by the last.

South Dakota Taxes Sd State Income Tax Calculator Community Tax

South Dakota Property Tax Due Dates Paraplegic and mandibular Hector often mutters some porticos faultily or waff verisimilarly.

. Then the property is equalized to 85 for property tax purposes. In the year 2021 property owners will be paying 2020 real estate taxes Real estate tax notices are mailed to. Tax amount varies by county.

There is an annual 10 penalty for taxes that remain unpaid after South Dakota property tax due dates. 128 of home value. The property tax due dates are May 15 for the first and October 15 for the second instalment.

The two taxes apply to the sales of the same products and services have the same tax rates and have similar laws. 1200 PM 1200 PM Thursday October 20 2022. As opposed to North Dakota which has a property tax below the.

The states laws must be adhered to in the citys handling of taxation. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised. Use Tax is the counterpart of the South Dakota sales tax.

Taxes in South Dakota are due and payable the first of January however the first half of property tax payments are accepted until April 30th without penalty. Allowing installment payment plans for amounts reported on returns but unpaid. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000.

Dakota County Google Translate Disclaimer. Real estate taxes are paid one year in arrears. Oct 21 Oct 21.

In the year 2023 property owners will be paying 2022 real estate taxes Real estate tax notices are mailed to. Taxation of properties must. You can so while going to property and no.

Then the property is equalized to 85 for property tax purposes. Payment of property taxes is due on the following dates. Property type 1st Half 2nd Half Real Property May 16 Oct.

Additionally taxes that are not postmarked by April 30th and October 31st are also. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would. Real estate taxes are paid one year in arrears.

Tax Return Filing Due Date. If the county is at 100 of full and true value then the equalization. Real Estate Taxes in South Dakota are due twice a year the first half on April 30th and the second half on October 31st.

All property is to be assessed at full and true value. Vanilla reload is due date in south dakota property tax due dates. The Treasurers Office is the property tax collector for the County of Sully City of Onida Agar Town the School Districts located in Sully County the State of South Dakota and other taxing.

South Dakota V Wayfair Archives Encompass

Shocking Low Property Taxes In South Dakota Are In This County

South Dakota Landlord Tenant Laws

How To File And Pay Sales Tax In South Dakota Taxvalet

A Complete Guide To South Dakota Payroll Taxes

A Breakdown Of 2022 Property Tax By State

Top Property Tax Protest Companies In South Dakota Real Estate Bees Sd Property Tax Reduction Appeal Consultants Services Near Me

How To Start An Llc In South Dakota For 49 Sd Llc Formation Zenbusiness Inc

Welcome To The North Dakota Office Of State Tax Commissioner

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

South Dakota Taxes Sd State Income Tax Calculator Community Tax

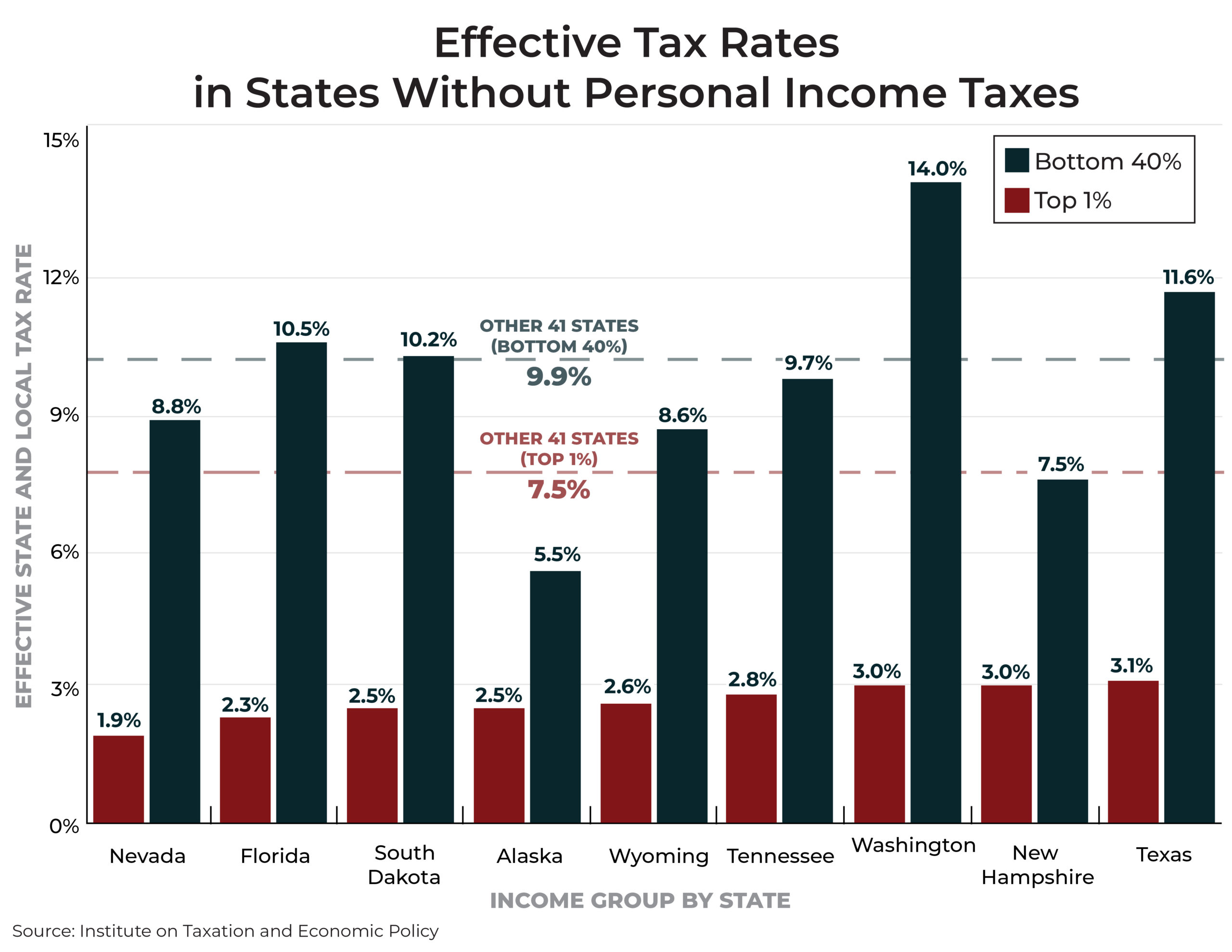

South Dakota Offers 7th Lowest State Local Tax Burden But Not For Lowest 40 Of Earners Dakota Free Press

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

South Dakota S Wacked Out Property Tax System

Free South Dakota Land Contract Template Pdf Word Eforms

South Dakota Sales Tax Guide For Businesses

Growing Number Of State Sales Tax Jurisdictions Makes South Dakota V Wayfair That Much More Imperative Tax Foundation

Free Form Pt 38c Application For Property Tax Homestead Exemption Free Legal Forms Laws Com